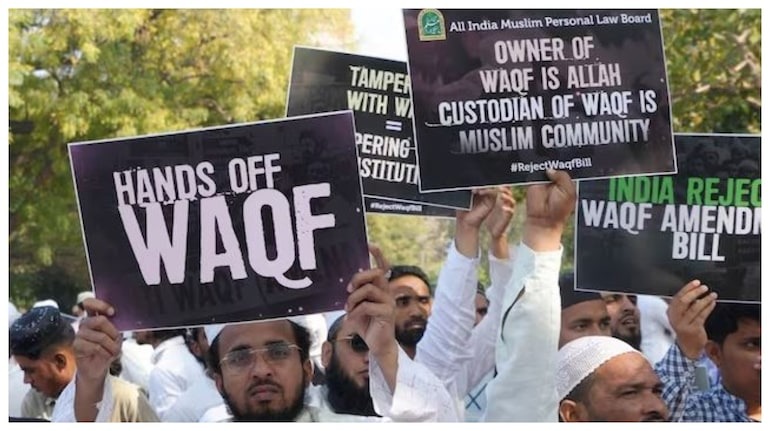

Parliament is expected to see a tense debate on Wednesday, as the Waqf (Amendment) Bill 2024 comes up for discussion in both Houses. The BJP-led NDA has the numbers to pass the bill, but the positions of allies like JD(U) and TDP—who rely on minority votes—will be closely observed.

Allies Likely to Support with Conditions

According to reports, JD(U) and TDP are expected to support the Bill during voting, but have requested specific changes:

TDP seeks to alter provisions allowing non-Muslims to be appointed to Waqf boards.

JD(U) strongly opposes retrospective implementation of the Bill, warning of legal complications and community unrest.

Understanding the Retrospective Impact

One of the contentious issues is the removal of "Waqf by user"—a concept in the 1995 Waqf Act that allowed properties used for religious or charitable purposes to be classified as Waqf without documentation.

If implemented retrospectively, this could:

Create disputes over long-recognized Waqf lands

Undermine claims to properties used for decades as mosques, graveyards, or religious institutions

JD(U) leaders insist that such a move could stoke unrest, especially in states like Bihar. The Centre has reportedly assured that retrospective application will not be part of the final law.

What is the Waqf (Amendment) Bill 2024?

The Bill aims to streamline the administration and governance of Waqf properties across India. Key objectives include:

Enhancing the efficiency of Waqf Boards

Leveraging technology for better property records

Redefining terms and improving the legal framework

Key Changes Proposed in the Bill

Waqf Boards must register all properties with district collectors for accurate valuation

Section 40: Transfers the power to identify Waqf properties from Tribunals to Collectors

Council Composition: Mandates at least two non-Muslim members on the Waqf Council

Women’s Representation: Mandatory inclusion of women on Waqf Boards

Removal of Section 107: Makes Waqf Boards subject to the 12-year limitation period under the Limitation Act, 1963, instead of allowing indefinite claims

Exclusion of Government Property: Any property identified as Waqf, but classified as government land, will not be treated as Waqf unless decided by the Collector

Revenue Transparency: Despite managing over 8.7 lakh properties across 9.4 lakh acres, annual revenue is just around ₹200 crore—raising efficiency concerns

Read More: Fact vs. Fiction Breaking Down the Rijiju-Rahul Clash Over the US Trade Deal

Share

Share