China's leading smartphone brand Vivo is accelerating its international expansion, aiming to generate 70% of its total revenue from overseas markets by 2027. According to Chief Operating Officer Hu Baishan, the company currently earns over 50% of its sales outside China. This will increase to 60% in 2025 and reach the 70% mark two years later.

Speaking at the Boao Asia Forum, Hu emphasized that overseas markets represent Vivo’s future growth path.

New Product Launches Highlight Global Focus

At the event, Vivo unveiled its flagship Vivo X200 Ultra smartphone, scheduled for release next month. The company also introduced a prototype of its upcoming virtual reality headset, due for testing by August, and announced a new AI-focused robotics research lab.

Top Smartphone Brand in China with Global Ambitions

In 2024, Vivo outperformed competitors like Apple, Huawei, and Xiaomi to become China’s top smartphone vendor, according to IDC. Despite this, the Chinese market faces saturation. Hu acknowledged that consumers are now replacing devices less frequently, and government subsidies have had only a temporary effect on demand.

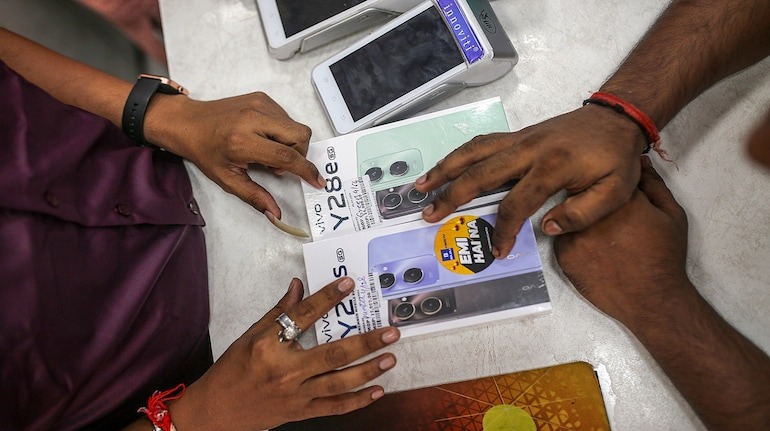

India and Southeast Asia Lead Vivo’s Overseas Push

India remains Vivo’s largest international market. The company plans to expand its premium device segment, targeting smartphones priced over $600. In Southeast Asia, Vivo aims to boost shipment volumes. It currently holds the top spot in Indonesia and second place in Malaysia, according to Canalys.

Hu explained that while no specific sales targets are set per country, growth remains the central focus for Vivo’s international teams.

Future Plans and Market Entry Strategy

Vivo is not yet targeting developed markets such as the US and Western Europe, where premium devices and telecom-linked sales dominate. However, Hu stated that Vivo may enter these regions within 3–5 years, potentially using new product categories like VR headsets as entry points.

Impact of US-China Trade Tensions Minimal on Vivo

Hu noted that the ongoing US-China trade tensions have not affected Vivo, as the company does not operate in the US. Additionally, Vivo sources components from non-US suppliers such as Sony (Japan) and MediaTek (Taiwan), insulating it from US export controls.

Read More: World Bank Approves 700 Million Dollars for Pakistan to Boost Economic Stability and Public Services

Share

Share