In a remarkable development, it has been reported that there will be no more charges or penalties forえby banks for not maintaining Minimum Average Balance (MAB) in an account. With this new regulation put forth, millions of bank account holders will now welcome the change of being able to maintain a zero balance in their accounts without fear of any hidden deductions, thus allowing users greater command over their finances.

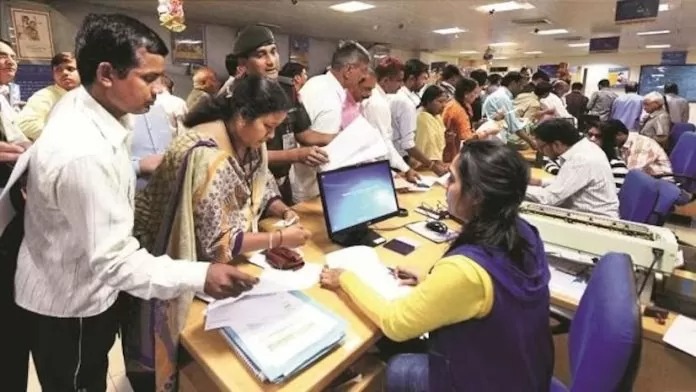

In the past, many banks implemented the MAB system whereby charge a penalty fee if a customer’s account balance dropped below a particular set limit. This practice created immense difficulty for low-income individuals, students, or those with very specific financial needs by turning what should have been a convenient service into a costly burden. Many consumers were regularly subjected to losing a portion of their income due to forced savings that were deducted without apologies.

MAB charges discouraged the economically advantageous for the poor bracket from owning and actively utilizing bank accounts. These added charges created a setback in the government’s attempt to give more of its citizens access to the formal banking system.

Notable Consequences of This Shift:

No More Financial Penalties: Users with a zero balance will no longer incur financial penalties. This alleviates a great deal of worry for many people.

Increased Inclusion: This change will likely enhance inclusivity, making the banking system significantly easier to access and less daunting for prospective customers.

More Flexibility: Users may freely withdraw cash from their accounts without the risk of incurring penalties for maintaining a minimum balance.

Eased Restrictions for Basic Accounts: Although many BSBDAs already had zero-balance features, this policy reinforces and broadens the non-penalty principle, thereby easing banking access for the masses.

This is a positive change because it enhances the focus on customers in the banking industry and increases financial equity and inclusion. People are no longer burdened by worrying about specific balance thresholds, allowing them to truly manage their bank accounts as essential instruments needed during daily life instead of cumbersome financial tools.

Read More: The Indonesia Jackpot Why Tata Motors Shares Just Hit a New 52-Week High

Share

Share