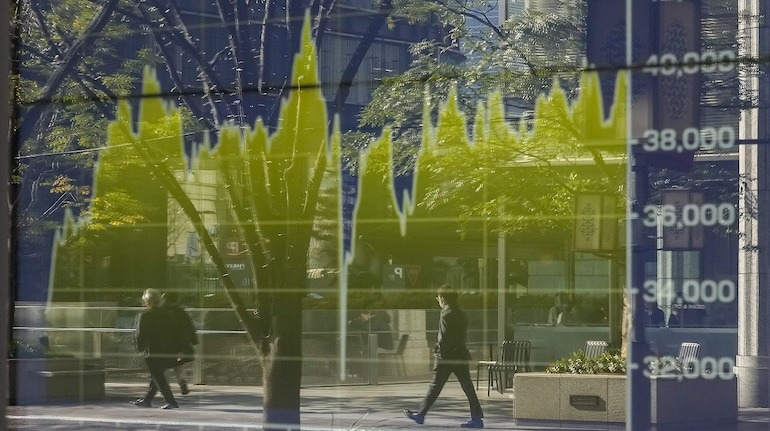

Asian stocks saw gains as enthusiasm for artificial intelligence lifted technology shares in Hong Kong and China, despite broader market caution due to ongoing tensions between the US and European Union over tariffs and the war in Ukraine.

Tencent Holdings Ltd. surged 6.6% in Hong Kong, extending its winning streak fueled by the excitement around DeepSeek’s AI debut. A key index of Asian stocks climbed to its highest level since early December, led by technology firms. Meanwhile, the dollar remained stable, and Treasury futures edged lower, with cash trading closed globally due to Presidents’ Day in the US.

China’s AI-driven stock market rally continues to build momentum, with DeepSeek’s technological breakthrough contributing to a $1.3 trillion surge in Chinese equities. The potential meeting between President Xi Jinping and e-commerce magnate Jack Ma this week could further bolster confidence. In contrast, growing geopolitical tensions between the US and Europe triggered declines in German and French bond futures.

Goldman Sachs Group Inc. raised its targets for Chinese equity benchmarks, though investor Michael Burry had trimmed some of his holdings in Chinese tech stocks just before DeepSeek’s breakthrough.

Meanwhile, US President Donald Trump’s proposed tariffs have prompted threats of retaliation, and Vice President JD Vance criticized long-standing European allies at a recent security conference. Efforts to negotiate an end to the war in Ukraine have left the European bloc sidelined.

“The unpredictable nature of the US administration continues to create uncertainty for short-term market participants,” said Marc Chandler, chief market strategist at Bannockburn Global Forex. “The bilateral talks between the US and Russia over Ukraine resemble the 1956 Suez Crisis, where US interests sharply diverged from those of the UK and France.”

Market Developments and Economic Data

Westpac Banking Corp.’s shares fell as much as 6% after reporting weaker profit margins. Japan’s economy expanded for a third consecutive quarter, driven by increased corporate investment and improved net exports.

Key economic data releases this week include inflation reports from Japan, the UK, and Canada, as well as employment figures from Australia. China’s banks are expected to maintain their loan prime rates steady after January’s credit expansion exceeded expectations, despite historically weak overall credit growth.

In commodities, oil extended its losses for a fourth consecutive day amid the prospect of increased supply from Iraq and Russia, driven by Trump’s push to end the three-year war in Ukraine. Meanwhile, gold edged higher, reflecting investor caution amid geopolitical uncertainties.

Read More: The Life Insurance for Your Stocks Breaking Down LIC’s Strategic Move into Cipla

Share

Share