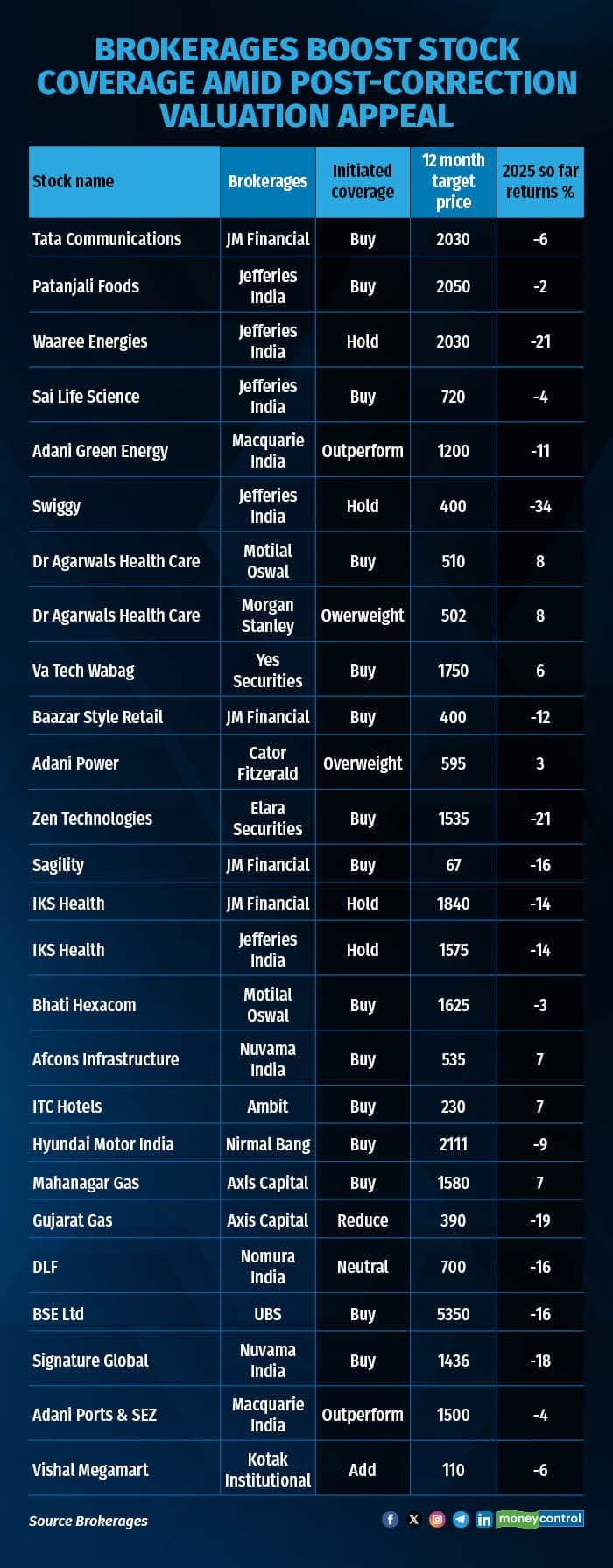

More than two dozen brokerage firms, including major names like Jefferies, Macquarie, Nomura, Morgan Stanley, JM Financial, Axis Capital, Elara Capital, and Motilal Oswal Financial Services, have expanded their stock coverage. This move comes in the wake of a recent market correction that led to significant drops in stock prices.

Analysts have started recommending new stocks as lower valuations make several companies appear more attractive for investment. These fresh ideas are intended to guide investors towards long-term opportunities.

Brokerages Respond to Attractive Valuations

Jefferies India and JM Financial have led the charge by initiating coverage on four stocks each. Jefferies now covers Patanjali India, Waaree Energies, Sai Life Sciences, and Swiggy, projecting strong returns over the next year. Meanwhile, JM Financial has added Tata Communications, Bazaar Style Retail, Sagility, and IKS Health to its coverage, with most receiving "buy" ratings.

Other firms have also announced fresh coverage:

- Motilal Oswal Financial Services: Dr. Agarwal’s Health, Bharti Hexacom

- Macquarie: Adani Green Energy

- Nuvama: Afcons Infrastructure

- Ambit: ITC Hotels

- Nirmal Bang: Hyundai Motors India

Expectations of Earnings Recovery Drive Analyst Interest

According to Deepak Jasani, an independent research analyst, the anticipation of an earnings recovery has contributed to this increased activity. With Q4 earnings set to begin in mid-April, the market expects positive surprises, prompting analysts to offer new insights.

Rajesh Palviya, Head of Technical Research at Axis Securities, highlighted that several market segments have corrected sharply in recent months. This has brought many stocks to appealing valuation levels, making them viable for long-term portfolios.

Stock Market Correction Creates Long-Term Opportunities

Since the market peaks reached in September last year, benchmark indices like Sensex and Nifty have declined around 10%, while broader indices have dropped over 19%. This decline was influenced by factors such as:

- Continuous foreign investor selling

- High stock valuations

- Weak earnings performance

- Slowing domestic economy

- Global trade tensions, including U.S. tariff policies

Despite these challenges, retail investors have remained steady, with minimal redemptions reported. Many are consulting with brokers to identify high-potential investments, particularly those holding cash reserves.

Analysts Focus on Growth Sectors Post-Correction

Palviya notes that the current market conditions could lead to a shift in sectoral leadership. As the recovery progresses, new sectors and stocks may emerge as frontrunners. Analysts are concentrating their research on areas with strong potential for earnings growth, which supports the recent surge in fresh coverage recommendations.

Read More: The Halwa Mystery Why Akhilesh Yadav is Questioning the New US-India Trade Deal

Share

Share

_1060084071_100x75.jpg)