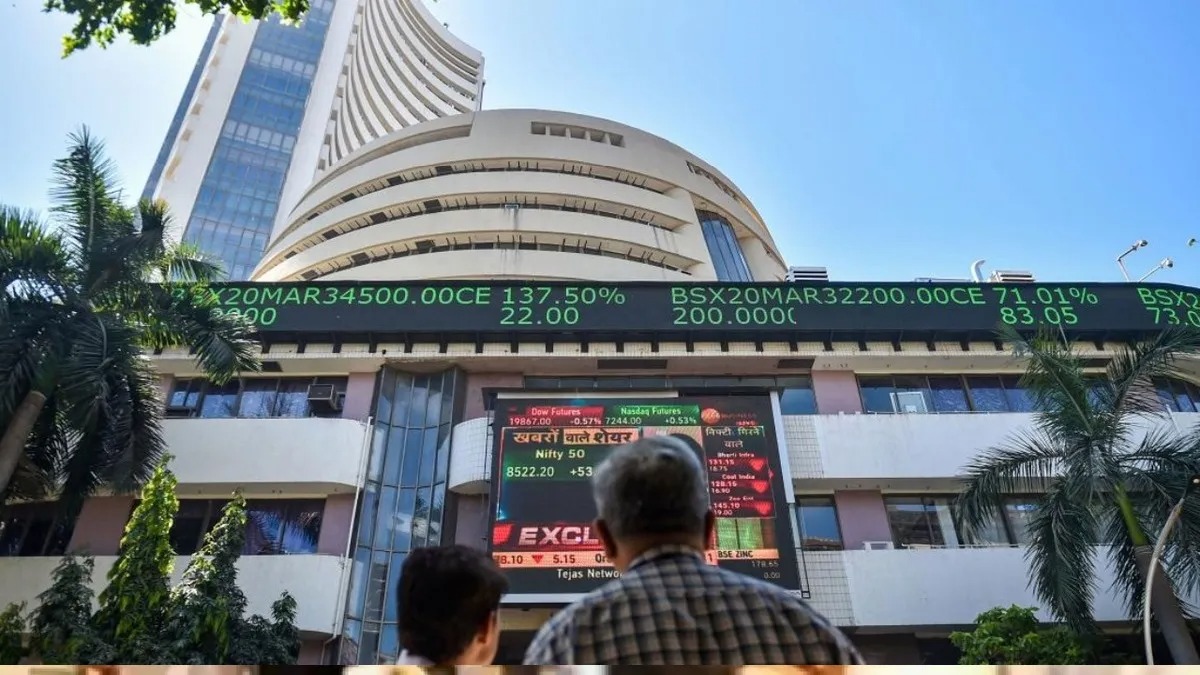

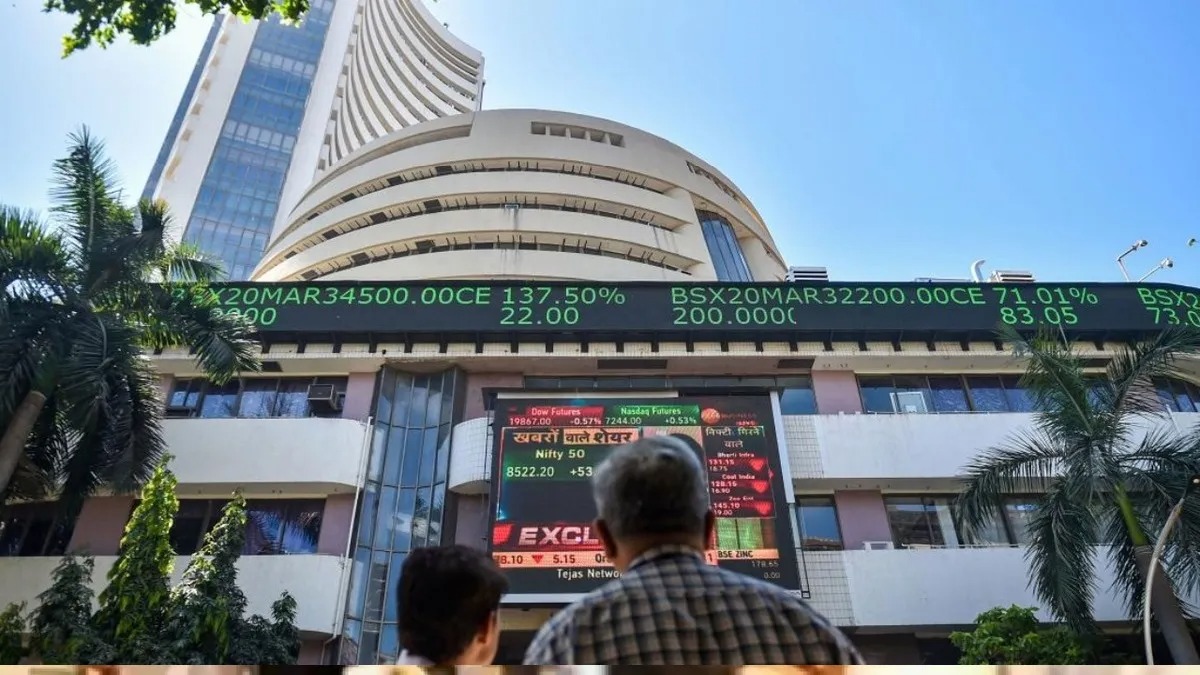

The stock market opened in the red on Diwali day. BSE opened at 79,805.96 points, down 136.22 points. At the same time, NSE Nifty is trading at 24,307.00 points with a decline of 33.85 points. Let us tell you that there may be fluctuations in the market today due to monthly expiry. So trade carefully. If we talk about declining stocks, then there is a decline in KOTAKBANK, TATA STEEL, M&M, NESTLEIND, ADANI PORTS, TATA MOTORS, BHARTIARTL, and SBI.

Shares of these companies fell.

Among the 30 companies listed on the Sensex, Tech Mahindra, Tata Consultancy Services, Infosys, HCL Technologies, Titan, Maruti Suzuki, and UltraTech Cement were the biggest losers. On the other hand, Larsen & Toubro’s stock jumped more than five percent. The major infrastructure company’s consolidated net profit in the July-September quarter rose by five percent to Rs 3,395 crore due to high income. Shares of Sun Pharma, Axis Bank, Tata Steel, and State Bank of India also remained in profit.

Foreign investors did a big sell-off

According to stock market data, foreign institutional investors (FIIs) were net sellers in the capital markets on Wednesday. They sold shares worth Rs 4,613.65 crore. In Asian markets, South Korea’s Kospi and Japan’s Nikkei 225 were in loss while China’s Shanghai Composite and Hong Kong’s Hang Seng were in gain. US markets closed with a decline on Tuesday. International standard Brent crude was at $ 72.90 per barrel with a gain of 0.48 percent.

The stock market closed in the red on Wednesday.

Let us tell you that the stock market closed in the red on Wednesday. The market closed down due to selling in bank and financial stocks amid weak trend in global markets. The BSE Sensex closed down 426.85 points or 0.53 percent at 79,942.18 points. The National Stock Exchange’s Nifty also closed down 126 points or 0.51 percent at 24,340.85 points. According to market experts, the softening of selling by foreign investors and some improvement in the valuation of domestic stocks are positive signs for the domestic market.

VK Vijayakumar, Chief Investment Strategist, at Geojit Financial Services, said, “Shortly, the market will be influenced by two factors, positive and negative. The positive thing is the rapid reduction in FIIs’ selling and it was Rs 548 crore on Tuesday. This is an indication that the trend of ‘sell in India and buy in China’ is coming to an end.” He said, “The market is expected to gain momentum shortly due to continued buying by domestic institutional investors (DIIs) and retail investors and softening of FIIs’ selling. Festivals are also expected to have a positive impact on the market.

Read More: Adani’s Green Leap The New 185 MW Wind Milestone You Need to Know About

Share

Share