There is good news for the small finance banks of the country. RBI on Friday proposed to allow small finance banks to give pre-approved loans through UPI. UPI is a fast real-time payment system developed by the National Payment Corporation of India (NPCI) for transactions through mobile phones. The scope of UPI was expanded in September 2023. Under this, pre-approved loans were linked through UPI. The facility was given to be used as a ‘funding’ account by commercial banks except for payment banks, small finance banks, and regional rural banks.

Financial products will be available at low cost and in less time. e

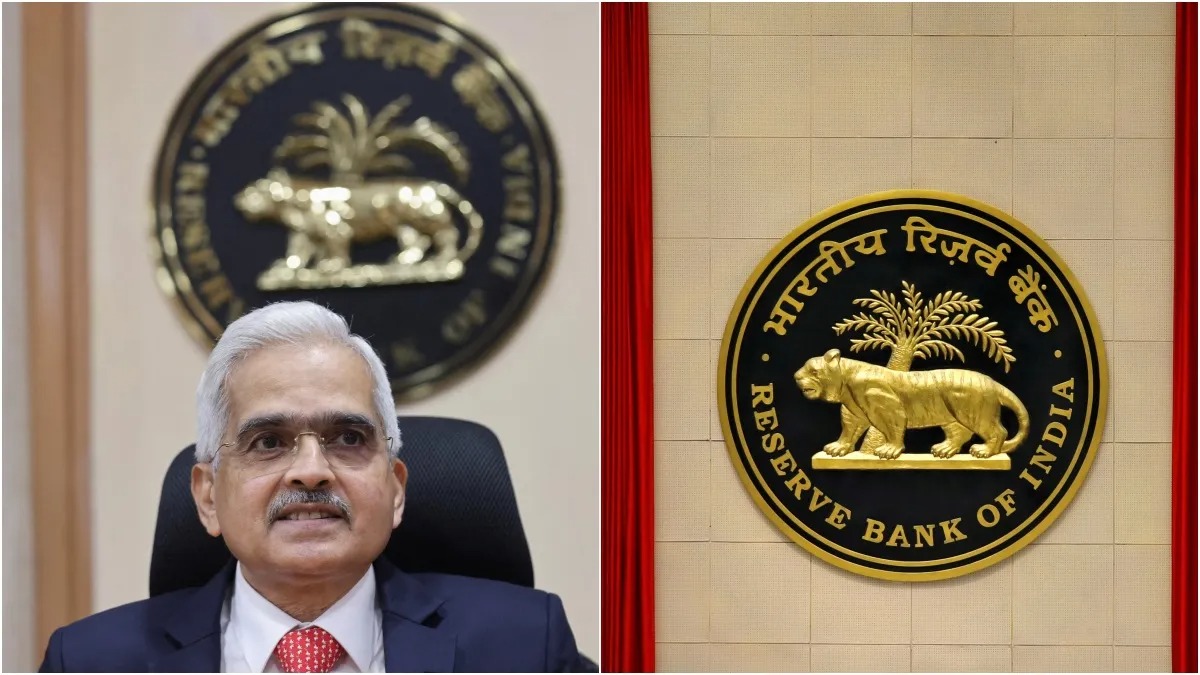

Reserve Bank of India Governor Shaktikanta Das said that there are opportunities to provide loans to customers at a lower cost and in a short period through pre-approved loans on UPI. He said that Small Finance Banks use high technology, and low-cost models to reach the end consumer and can play an important role in expanding the reach of loans on UPI. Announcing the bi-monthly monetary policy, Das said, “Therefore, it is proposed to allow Small Finance Banks to provide pre-approved loans through UPI. The necessary guidelines will be issued soon.

RBI will start a podcast

The governor also said that the Reserve Bank is using traditional as well as new-age communication technology to explain the rationale behind its decisions and disseminate various awareness messages to a wide range of people to make its decisions more transparent and effective. The central bank has been expanding the scope of its various public awareness activities, including social media, over the past few years. Continuing this effort, the Reserve Bank proposes to launch ‘podcasts’ for wider dissemination of information of interest to the general public, Das said.

Read More: The Indonesia Jackpot Why Tata Motors Shares Just Hit a New 52-Week High

Share

Share