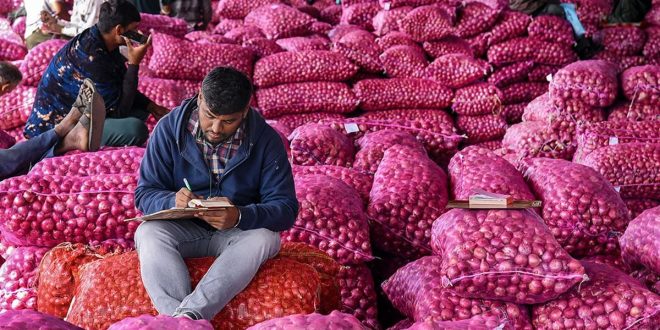

Onion Export: Amidst the Lok Sabha elections, the government removed the ban on export of ...

Read More »-

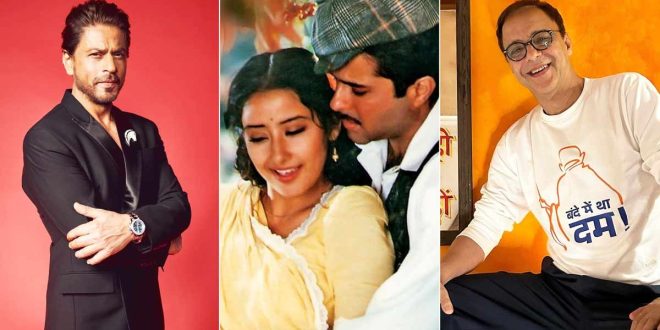

Vidhu Vinod Chopra wanted to cast Shah Rukh Khan for this film, not Anil Kapoor.

Vidhu Vinod Chopra on Shah Rukh Khan: Bollywood’s famous filmmaker Vidhu Vinod Chopra has given many ...

Read More » -

Akshay Kumar Kickstarts Shooting for ‘Jolly LLB 3’: Inside the Buzz

-

Unlock Your Destiny: 5 Powerful Saturday Rituals to Win Shani’s Favor

The Significance of Charity in Hinduism In Hinduism, the act of giving, known as ‘Daan’, ...

Read More » -

Astrology Alert: 5 Zodiac Signs Experiencing Rare Cosmic Blessings Today

-

Unlock Tuesday’s Blessings: 5 Powerful Mangalwar Rituals for Peace and Prosperity

-

Wedding Dreams: Harbingers of Joy or Warnings from the Unconscious?

-

Avoid Shani Dev’s Wrath: The Daily Mistakes You Must Stop Making Now!

-

IPL 2024: CSK got a big blow in the middle of IPL, after Deepak Chahar, this star bowler also got injured.

IPl 2024 Chennai Super Kings: Difficulties are not showing any signs of slowing down for Chennai ...

Read More » -

Rajasthan Royals and the Playoff Ticket: A Closer Look at Today’s Crucial IPL Match

-

Samson’s Fiery Bat Lights Up IPL 2024: Is He the Top Pick for the T20 World Cup?

-

Lucknow Super Giants’ IPL 2024 Campaign: The Mayank Yadav Fitness Miracle

-

Watch This Young Prodigy Smash Records: 20 Sixes and 6 Fours in Just 25 Balls

-

Maulvi, Nupur Sharma, arrested from Surat on charges of conspiracy to murder Hindu leaders, had threatened to kill Raja Singh

Surat News: Gujarat Police has arrested Maulana, who had threatened to kill many prominent Hindutva faces ...

Read More » -

Spicing Up Exports: How India’s New ETO Testing Mandate Revolutionizes Spice Trade

-

Unraveling the Mystery: AstraZeneca Addresses Blood Clot Concerns in 10 Key Points

-

Exploding Myths: Unpacking Owaisi’s Claims on Condom Use Among Muslims with Government Data

-

Lok Sabha 2024: A Tale of Raja and Nawab in Modern Indian Politics

Suspense Crime Sach Ka Dam

Suspense Crime Sach Ka Dam