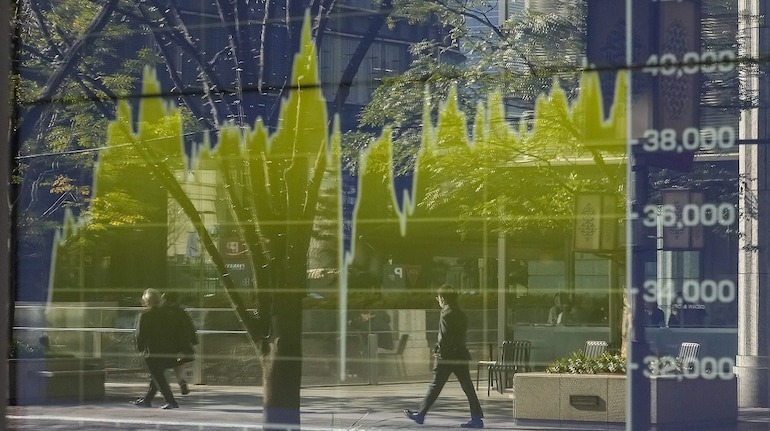

Shares in Asia stumbled at the start following another US consumer confidence figure which raises concerns pertaining to the world’s economy. Treasuries ticked higher after 10 year yields fell to their lowest this year.

A metric of regional stocks fell for the third consecutive day as futures indicated a recovery in Hong Kong after tech shares sunk on Tuesday. The Japanese Yen appreciated to its highest value in over four months due to safe haven demands and speculation that the bank of Japan will persist in its rate hikes. The S&P 500 set a five week low while the index of mega caps deepened the drawdown from its zenith above 10%.

US consumer confidence dipped the most since August 2021 due to fears revolving the economical forecast. A comprehensive survey of retail, services and housing sectors released in the last week was rather disappointing. Such events have caused investors to increase their positions on a Federal Reserve interest cut despite the increase in inflation expectations.

“Concerns surrounding the strength of the US economy seem to be on the forefront,” stated Alvin Tan, Head of Asia FX Strategy at RBC Capital Markets. According to him, the market currently incorporates cuts of over 50 basis points from the Fed by the end of the year.

An index of US-listed Chinese shares rebounded by 0.6% following a 5.2% drop on Monday. Global investors who anticipated a pronounced recovery in Chinese equities have found themselves disappointed. Trump’s decisions to further sever the economic relations between China and the US have started to rattle their sentiments.

The price on 10-year U.S. Treasury Bonds decreased by 1 basis points as opposed to a decrease of 11 basis points overnight. Other segments of the market also grazed lower yields, including Japanese and Australian Bonds, which fell during the start of trading on Wednesday. Now, money markets expect the Fed to implement cuts exceeding two 25 basis point cuts in 2025. A gauge for the dollar dipped by 0.1 percent.

After Trump’s signed executive order instructing Commerce to investigate tariffs that can be imposed on Copper, prices saw a hefty spike. Copper continued to climb.

Thus far investors have remained on the edge of their seats for this weeks reading. A fierce deceleration is expected from what the Fed uses to measure inflation, the core personal consumption expenditures price index. A measurable deceleration that has not been seen since June.

“It will provide further insight regarding how consumers view their purchasing power,” Kenwell stated, “Investors will benefit from this report, especially if the reading is inline or lower.”

With all the US stocks taking a massive hit both systematically and technically, traders are on commotion after Nvidia Corp. shares slid by 2.8%. On Wednesday, they will be closely monitoring Nvidia’s earnings, who has become a key player in Artificial Intelligence.

Gold has been slowly retreating while oil is slowly attempting to reach the $60 mark. This comes after the New York market gave up on the alarming economic outlook. In early Wednesday, Bitcoin plummeted, adding to the ongoing losses from the previous night.

Read More: The Life Insurance for Your Stocks Breaking Down LIC’s Strategic Move into Cipla

Share

Share