RBI’s Monetary Policy Review: Navigating Economic Challenges

RBI’s Monetary Policy Review: Navigating Economic Challenges

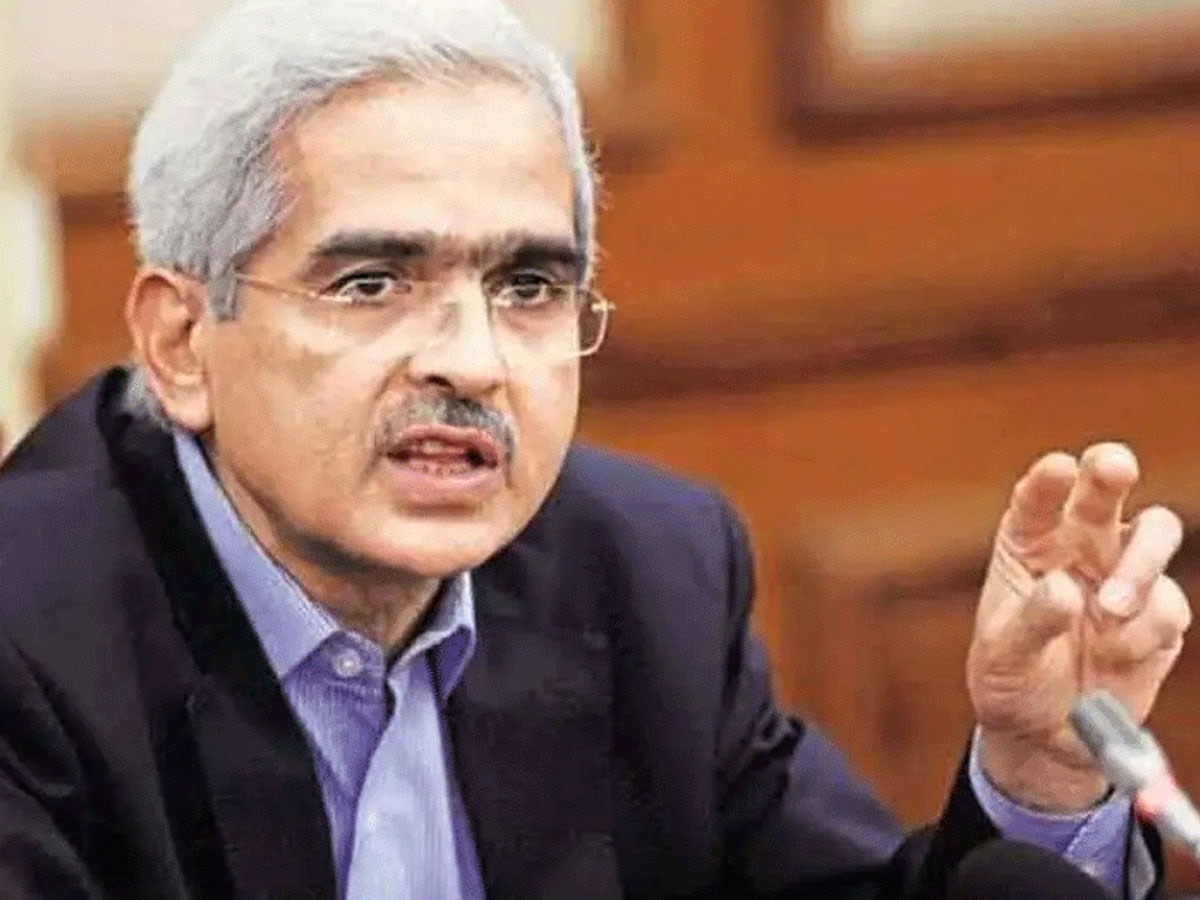

The recent monetary policy review by Reserve Bank of India (RBI) Governor Shaktikanta Das has unveiled crucial decisions that will shape the economic landscape in the coming months. In a three-day long monetary policy committee (MPC) meeting, the RBI decided to maintain the status quo on the repo rate, keeping it steady at 6.5%. Let’s delve into the intricacies of the decisions made and their implications.

Stability in Repo Rate

Despite speculations and uncertainties, the RBI has opted not to make any changes to the repo rate. This decision, reached unanimously during the MPC meeting, signifies the central bank’s commitment to maintaining stability in the financial markets.

RBI’s Economic Outlook

Governor Shaktikanta Das, addressing the media post the MPC meeting, expressed confidence in the robustness of the Indian economy. Despite global uncertainties, Das highlighted the nation’s solid economic foundation, attributing it to prudent policies and fiscal measures.

Focus on Economic Growth

In a bid to stimulate economic growth, the RBI has softened its monetary policy stance. The governor emphasized the need for encouraging private sector investments, paving the way for a more dynamic economic landscape.

Inflation Concerns

Shaktikanta Das acknowledged concerns about rising food inflation. While maintaining a vigilant stance, the RBI aims to bring the inflation rate down to the targeted 4%, balancing economic growth with price stability.

Monetary Tools in Action

Key monetary tools like the Standing Deposit Facility (SDF) rate and the Marginal Standing Facility (MSF) rate remain unchanged at 6.25% and 6.75%, respectively. These tools play a crucial role in regulating liquidity in the banking system.

Consumer Price Index (CPI) Trends

Analyzing the current trends in the Consumer Price Index (CPI), the RBI aims to manage inflation effectively. Shaktikanta Das provided insights into the strategies the central bank will employ to control inflation without hampering economic growth.

Fiscal Policies Impact

The impact of government expenditure on economic growth was discussed during the MPC meeting. The RBI recognizes the pivotal role of fiscal policies in navigating economic challenges and fostering stability.

Manufacturing Sector Growth

Positive indicators from the manufacturing sector were highlighted, signaling a potential upswing. Government spending is expected to play a crucial role in boosting industrial growth and creating a more resilient economy.

Rising Household Demand

An analysis of increased demand in the household sector indicates positive economic trends. The implications of rising household demand on overall economic health were discussed, pointing towards a more optimistic future.

Projections for GDP Growth

RBI’s optimistic outlook on GDP growth is a beacon of hope. The predictions for the next fiscal year reflect the central bank’s confidence in the nation’s ability to rebound from challenges and achieve sustainable growth.

Challenges in Achieving Inflation Targets

Governor Das acknowledged the challenges in achieving inflation targets. Factors contributing to these challenges were discussed, and the RBI outlined its strategies to address them effectively.

Global Economic Factors

The impact of global economic uncertainties on India was considered. Shaktikanta Das assured that the RBI is prepared to tackle external challenges, showcasing the central bank’s proactive approach to global economic dynamics.

Roadmap for the Future

The article has explored the recent decisions made by the RBI and Governor Shaktikanta Das’s vision for the future. The roadmap includes future policies and initiatives aimed at fostering economic growth, stability, and resilience.

In conclusion, the recent monetary policy review by the RBI reflects a balanced approach to navigating economic challenges. The decisions made underscore the central bank’s commitment to fostering economic growth while addressing inflation concerns. As India charts its course in a dynamic global economy, the RBI’s strategies play a pivotal role in ensuring stability and sustained growth.

Suspense Crime Sach Ka Dam

Suspense Crime Sach Ka Dam