Food Inflation News: Navigating the Fluctuations in Food Prices Amidst Economic Concerns

Food inflation has become a cause for concern, with the prices of food products experiencing a rollercoaster ride amidst an environment filled with economic uncertainties. The recent meeting of the Reserve Bank of India (RBI) sheds light on the worries surrounding inflation, prompting discussions on strategies to address the issue.

Understanding the Impact of Volatility

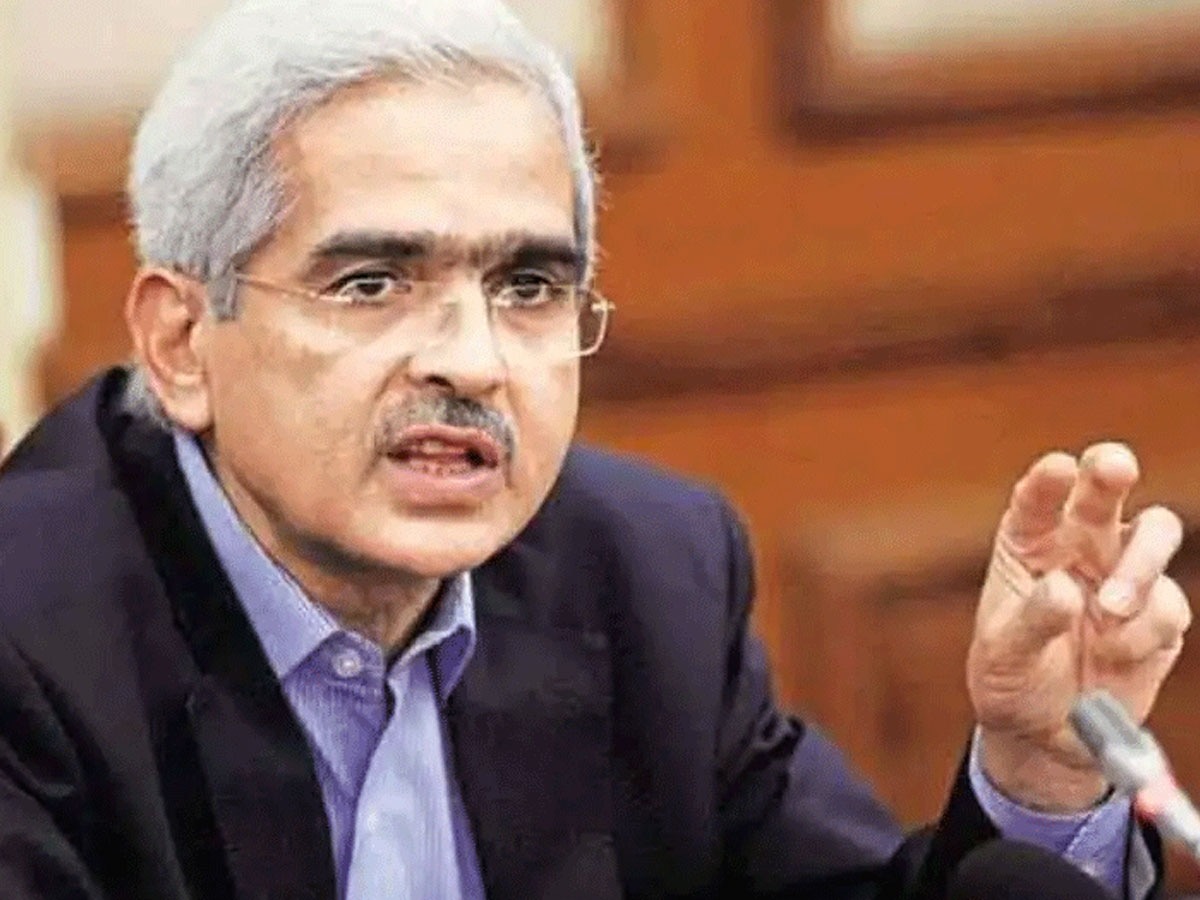

Governor Shaktikanta Das, leading a six-member Monetary Policy Committee (MPC), expressed concerns about the potential impact of unpredictable and erratic changes in food prices. The meeting, held between December 6 and 8, focused on acknowledging the common apprehensions related to inflation and resolved to maintain the repo rate at 6.5 percent.

Predicting the Ripple Effect of Inflation

Governor Das highlighted the anticipation of inflation being influenced by the instability and unpredictable fluctuations in food prices, coupled with regular seasonal changes. The rise in the cost of vegetables has raised alarms about the prospect of increased inflation. Governor Das emphasized the need for heightened vigilance, stating, “We must remain extra cautious about any signs of rapid inflation. Even the slightest negligence could derail the process of bringing inflation down.”

Giving Priority to Inflation Concerns

Stressing the significance of addressing inflation in the current scenario, RBI Governor Das emphasized the necessity for an active deflationary monetary policy. Any policy changes in the near future will be cautious and consider the associated risks. Deputy Governor and MPC member Michael Debabrata Patra highlighted the importance of prioritizing inflation concerns over maintaining interest rates at previous levels.

Importance of Diligent Monetary Policy

Deputy Governor Patra emphasized the need for the monetary policy to remain vigilant in these circumstances. He voted in favor of keeping the policy rate at the existing level, stating that, in comparison to the inflationary pressures, giving more importance to inflation in the MPC is necessary.

Insights from RBI’s Executive Director

Rajiv Ranjan, Executive Director of RBI and MPC member, remarked on the robust performance of the economy. He stressed the need to continue supporting this growth path by maintaining stability in prices. In the MPC, the consensus was clear that stability in value should be the priority.

In conclusion, the recent discussions at the RBI’s MPC meeting have highlighted the concerns about food inflation and its potential impact on the economy. The emphasis on maintaining the status quo in interest rates and the need for an active deflationary monetary policy reflects the cautious approach towards handling inflationary pressures.

Suspense Crime Sach Ka Dam

Suspense Crime Sach Ka Dam