Onion Export: Amidst the Lok Sabha elections, the government removed the ban on export of ...

Read More »-

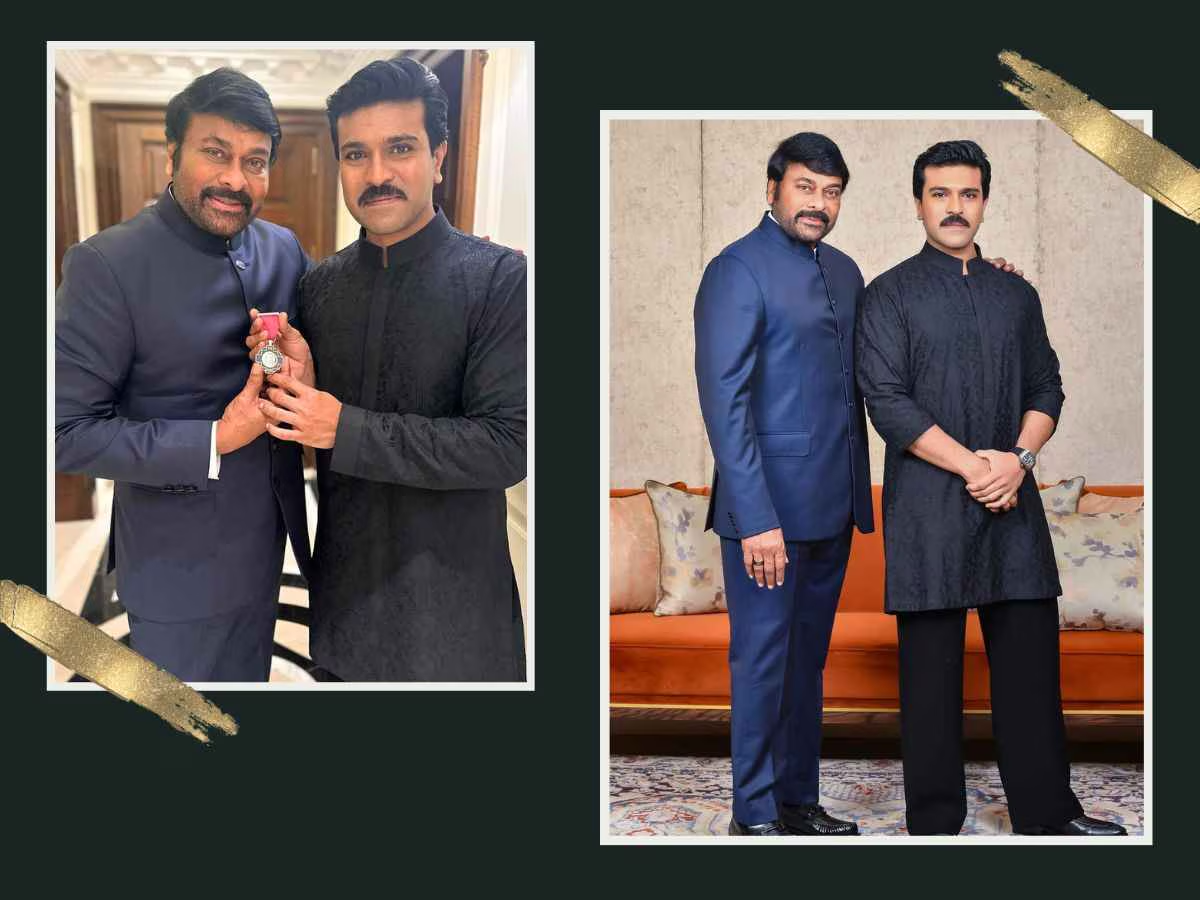

Megastar Chiranjeevi receives Padma Vibhushan award, son Ram Charan writes special post for father

Chiranjeevi Honoured with Padma Vibhushan: President Droupadi Murmu honoured several personalities including megastar Konidela Chiranjeevi with ...

Read More » -

Happy Birthday, Sai Pallavi: Unveiling the Power Behind Her Groundbreaking Roles

-

Sita Navami 2024: Unlock Prosperity with These Timely Rituals

Sita Navami: Celebrating the Divine Birth of Mata Sita Sita Navami, also known as Janaki ...

Read More » -

Unlock Your Destiny: 5 Powerful Saturday Rituals to Win Shani’s Favor

-

Astrology Alert: 5 Zodiac Signs Experiencing Rare Cosmic Blessings Today

-

Unlock Tuesday’s Blessings: 5 Powerful Mangalwar Rituals for Peace and Prosperity

-

Wedding Dreams: Harbingers of Joy or Warnings from the Unconscious?

-

Caught on Camera: LSG Owner’s Explosive Reaction to IPL 2024 Humiliation

Sunrisers Hyderabad Decimate Lucknow Super Giants in a Spectacular Victory The Indian Premier League (IPL) ...

Read More » -

Mumbai Triumphs Over Hyderabad: How This Victory Shapes the Playoff Race

-

IPL 2024: CSK got a big blow in the middle of IPL, after Deepak Chahar, this star bowler also got injured.

-

Rajasthan Royals and the Playoff Ticket: A Closer Look at Today’s Crucial IPL Match

-

Samson’s Fiery Bat Lights Up IPL 2024: Is He the Top Pick for the T20 World Cup?

-

Aravalli Hills: ‘Supreme’ ban on mining in Aravallis, SC warns Delhi-Haryana-Rajasthan-Gujarat

Supreme Court bars fresh mining leases: The Supreme Court (SC) has taken a big decision to ...

Read More » -

Diplomatic Shockwave: How a Danish Ambassador’s Tweet Sparked Controversy at the Delhi Embassy

-

IMD Warnings Decoded: What This Heatwave Means for You and Your Family

-

Maulvi, Nupur Sharma, arrested from Surat on charges of conspiracy to murder Hindu leaders, had threatened to kill Raja Singh

-

Spicing Up Exports: How India’s New ETO Testing Mandate Revolutionizes Spice Trade

Suspense Crime Sach Ka Dam

Suspense Crime Sach Ka Dam