Indian Railways Update: Tackling Travel Woes Amid Service Disruptions Amidst the hustle and bustle of ...

Read More »-

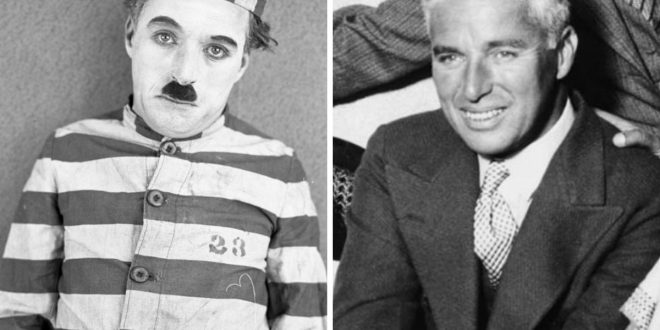

Laughing Through Silence: The Remarkable Story of Charlie Chaplin, The Actor Who Touched Hearts Without Uttering a Single Word

Remembering Charlie Chaplin Charlie Chaplin, the legendary figure of comedy, continues to be celebrated and ...

Read More » -

Unlocking Excitement: Janhvi Kapoor Reveals Stunning ‘Mr. & Mrs. Mahi’ Poster with Thrilling Number 7 Twist

-

agannath Mandir Puri: A New Era of Scrutiny Begins – Exploring the Intriguing Debate on Non-Hindu Presence and Lineage Inquiry

Puri Jagannath Temple New Rules: Balancing Tradition with Modernity The Puri Jagannath Temple, nestled in ...

Read More » -

Eclipsing Negativity: How to Embrace Surya Grahan for a Blessed Chaitra Navratri 2024

-

Unlock Instant Prosperity: Navratri Rituals That Can Make You Rich Overnight!

-

Ram Mandir Ayodhya: The festival of Mata Durga will be celebrated with pomp in Ram temple, Shakti worship will be held for 9 days

-

Divine Hues: Embrace the Spiritual Significance of Navratri 2024 Colors for Inner Fulfillment

-

Battle Royale: LSG vs. KKR in IPL 2024 Night Riders’ Fortress – Who Will Prevail?

IPL 2024: KKR vs LSG – Clash of Titans at Eden Gardens The scintillating battleground ...

Read More » -

Ravindra Jadeja’s Spectacular Record-Breaking Performance Against KKR: Outshining All-Rounders like Bravo and Russel

-

Babar Azam: Pakistan’s Cricket Savior or the New Shahid Afridi? Exploring the Captaincy Dynamics

-

Shocker in IPL 2024: English Player Betrays LSG! What Happened Next Will Leave You Stunned

-

Rohit Sharma’s Epic Response Leaves Fans Speechless After Embrace with Pandya – Watch the Viral Moment Unfold

-

Unraveling the Mystery: What Made This Egg from Jammu and Kashmir Worth Over Two Lakh Rupees?

Unveiling the Mystery: The Tale of the Golden Egg Intriguing stories often narrate the adventures ...

Read More » -

BJP’s Game-Changing Manifesto: Zero Electricity Bills, Free Ration-Gas, and Modi’s Guarantee

-

Unveiling Religious Conversion: Breaking News from Allahabad High Court

-

Anil Ambani Stunned by Supreme Court: Historic Bench Reversal Sparks Legal Storm

-

DGCA’s New Rule on In-flight Alcohol: How Much is Too Much for Passengers?

Suspense Crime Sach Ka Dam

Suspense Crime Sach Ka Dam